Payment Provider Security

Client-Side Security for Payment Providers and Processors

Protect your payment ecosystem from client-side attacks and ensure PCI DSS compliance.

Payment providers face increasing client-side threats as the PCI DSS v4.0.1 requirements 6.4.3 and 11.6.1 tries to combat. Providers need to maintain security across their entire ecosystem, particularly due to vulnerabilities introduced by 3rd party scripts and inadequate visibility into client-side activity.

Compliance

Many merchant customers lack expertise to self-attest under the new PCI SSC SAQ requirements. SAQ A companies look at payment providers to be compliant as written in the PCI DSS v4.0.1, 6.4.3 and 11.6.1 requirements.

With c/side, all required steps are done automatically, complete to the weekly report needed when audit time comes.

Using c/side for compliance automatically ensures your customers are compliant as well.

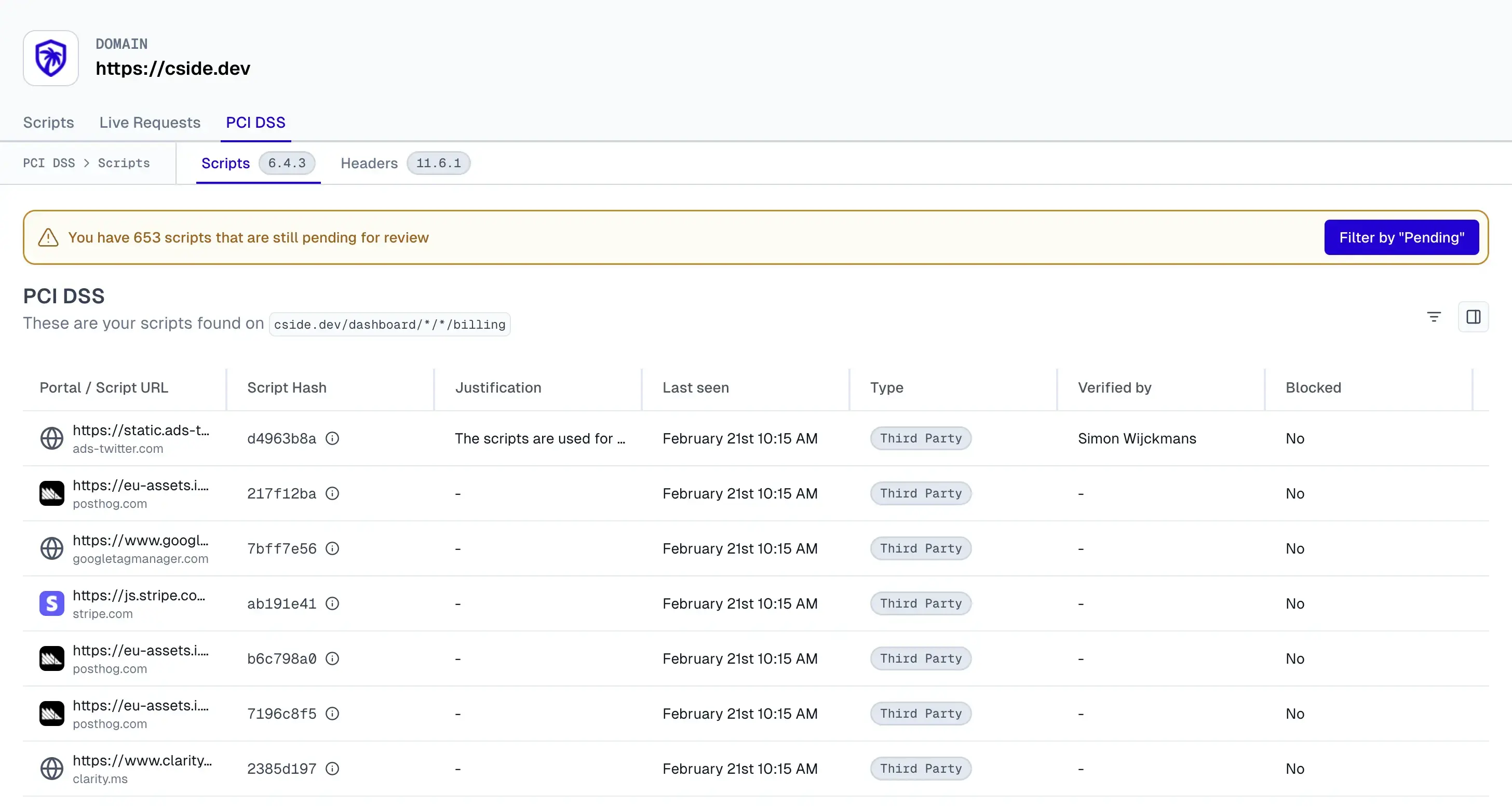

Compliance in the c/side dashboard

Security

Protection from browser rendered 3rd party JavaScript attacks, securing the input of credit card and private information. c/side is the only solution with a proxy service - seeing the exact payload of all scripts to promise the best possible protection. Some customers prefer other protection methods, which we provide as well.

Unlike other methods, c/side actively analyzes and protects against evolving threats in real-time. Our proxy-based architecture inspects the exact payload delivered to end users, ensuring no blind spots. All traffic is monitored and stored, making analysis after the fact a breeze.

Security Headers in the c/side dashboard

Understanding the Client-Side Security Challenges

Payment providers face increasing cyber threats, particularly with the new PCI DSS 4.0.1 compliance updates. Many providers struggle to maintain security across their entire ecosystem, particularly due to vulnerabilities introduced by third-party scripts and inadequate visibility into client-side activity.

- Complex Compliance RequirementsNavigating PCI DSS SAQ A, DORA, and GDPR while ensuring merchant compliance.

- Third-Party Script VulnerabilitiesUnmanaged scripts expose payment pages to skimming attacks.

- Merchant Non-ComplianceMany merchants unknowingly introduce client-side security risks that payment providers inherit.

- Credential Theft and Account TakeoversPayment fraud and regulatory fines resulting from insecure payment flows.

Use Cases: How c/side Helps Payment Providers Strengthen Security

Ensuring Merchant PCI DSS Compliance

Pain Points Addressed:

- Merchants lack expertise to self-attest under the new SAQ A requirements.

- Requirement 6.4.3 and 11.6.1 removals shift responsibility to merchants, creating security gaps.

- High risk of non-compliance penalties impacting both providers and merchants.

How We Solve It:

- Automated Compliance Monitoring: Provides real-time validation that merchant payment pages comply with PCI DSS 4.0.1.

- SAQ A Readiness Checks: Identifies merchants at risk of disqualification due to client-side script vulnerabilities.

- Detailed Reporting & Risk Scoring: Helps payment providers proactively assess which merchants require intervention.

Third-Party Script Management for Secure Payment Pages

Pain Points Addressed:

- Unauthorized script modifications introduce security risks and skimming threats.

- Redirect payment pages, embedded iframes, and custom forms each have distinct attack vectors.

- Manual monitoring is inefficient and prone to errors.

How We Solve It:

- Real-Time Script Analysis: Detects and mitigates unauthorized modifications before they impact transactions.

- Automated Workflows: Eliminates manual review burdens, allowing teams to focus on high-risk merchants.

- Proactive Threat Mitigation: Prevents Magecart-style client-side attacks that compromise cardholder data.

Session Token Protection to Prevent Payment Fraud

Pain Points Addressed:

- Session hijacking and credential theft lead to fraud and regulatory penalties.

- Traditional fraud prevention tools lack real-time insights into client-side activity.

- Customer trust and brand reputation suffer when breaches occur.

How We Solve It:

- End-to-End Token Protection: Monitors and secures session tokens to prevent unauthorized takeovers.

- Continuous Threat Detection: Identifies anomalies and flags suspicious merchant transactions in real time.

- Seamless Integration: Works with iframe-based, redirect, and API-driven payment flows.

Why c/side Stands Out in Payment Provider Security

- Real-Time Threat Mitigation: Continuous monitoring ensures instant response to evolving threats.

- Compliance Simplified: Automated PCI DSS workflows streamline audits and reporting.

- Merchant Visibility: Enables providers to assess and enforce security policies across their ecosystem.

- Operational Efficiency: Reduces fraud-related costs and manual security overhead.

- Enhanced Customer Trust: Ensures seamless and secure payment experiences.